Multiple Choice

A) $857.

B) $3,357.

C) $6,000.

D) $5,429.

E) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: The method for tax amortization is always

Q10: The manner in which a business amortizes

Q48: In general, a taxpayer should select longer-lived

Q50: Assume that Brittany acquires a competitor's assets

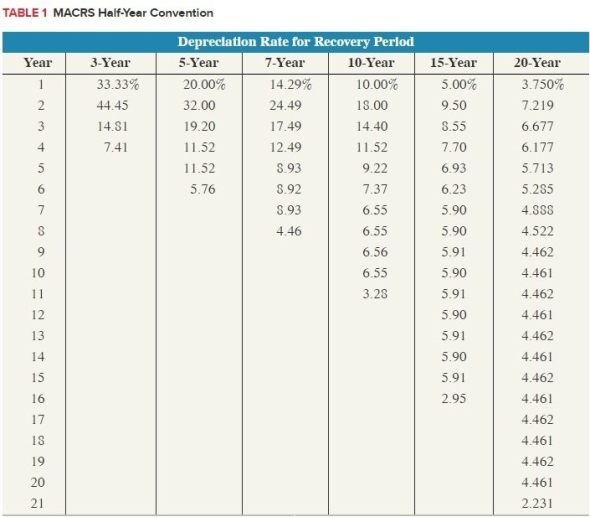

Q56: Janey purchased machinery on April 8th of

Q57: Which depreciation convention is the general rule

Q58: Jasmine started a new business in the

Q59: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2607/.jpg" alt=" A) $3,573. B)

Q101: If a machine (seven-year property) being depreciated

Q128: If a taxpayer places only one asset