Multiple Choice

A) $1,728.

B) $3,456.

C) $1,874.

D) $432.

E) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Oksana started an LLC on November 2

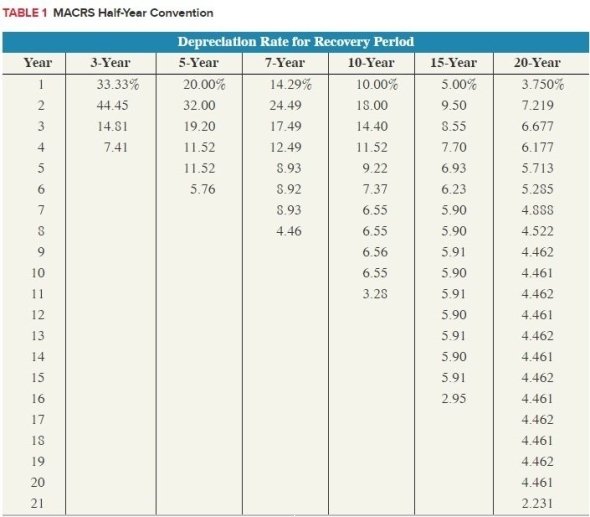

Q28: Taxpayers use the half-year convention for all

Q47: In general, major integrated oil and gas

Q57: The mid-month convention applies to real property

Q67: Patin Corporation began business on September 23rd

Q71: Which of the following would be considered

Q73: Yasmin purchased two assets during the current

Q74: Olney LLC only purchased one asset this

Q99: Depletion is the method taxpayers use to

Q108: All assets subject to amortization have the