Essay

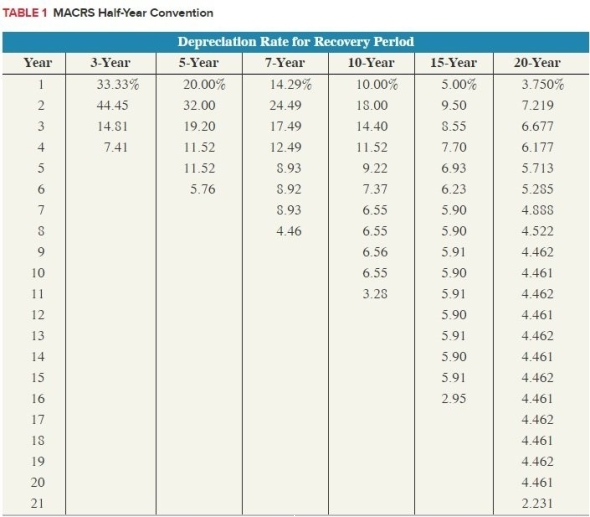

Flax, LLC purchased only one asset this year. Flax placed in service a computer (5-year property) on January 16 with a basis of $14,000. Calculate the maximum depreciation expense (ignoring §179 and bonus depreciation). (Use MACRS Table 1)

Correct Answer:

Verified

$2,800

The asset's recovery period is 5 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The asset's recovery period is 5 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Oksana started an LLC on November 2

Q44: Sequoia purchased the rights to cut timber

Q73: Yasmin purchased two assets during the current

Q74: Olney LLC only purchased one asset this

Q76: An example of an asset that is

Q78: Timothy purchased a new computer for his

Q79: What is the amortization expense with respect

Q82: Santa Fe purchased the rights to extract

Q108: All assets subject to amortization have the

Q113: The alternative depreciation system requires both a