Essay

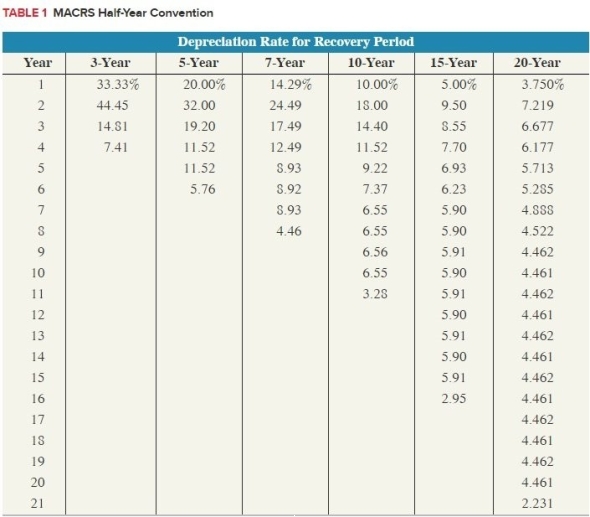

Eddie purchased only one asset during the current year. Eddie placed in service furniture (7-year property) on May 1st with a basis of $26,500. Calculate the maximum depreciation expense, rounded to the nearest whole number (ignoring §179 and bonus depreciation). (Use MACRS Table 1)

Correct Answer:

Verified

$3,787

The asset's recovery period is 7 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The asset's recovery period is 7 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Geithner LLC patented a process it developed

Q6: Boxer LLC has acquired various types of

Q9: Jorge purchased a copyright for use in

Q12: Tom Tom LLC purchased a rental house

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2607/.jpg" alt=" A) $336. B)

Q14: Kristine sold two assets on March 20th

Q32: If a business mistakenly claims too little

Q40: Taxpayers may use historical data to determine

Q82: Businesses deduct percentage depletion when they sell

Q121: The basis for a personal-use asset converted