Essay

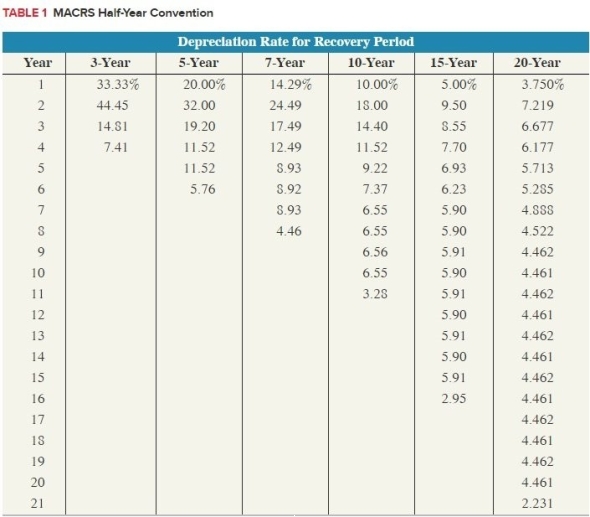

Amit purchased two assets during the current year. Amit placed in service computer equipment(5-year property) on April 16th with a basis of $5,000 and furniture (7-year property) on September9th with a basis of $20,000. Calculate the maximum depreciation expense (ignoring §179 and bonus depreciation). (Use MACRS Table 1)

Correct Answer:

Verified

$3,858

The half-year convention applies ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The half-year convention applies ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Tom Tom LLC purchased a rental house

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2607/.jpg" alt=" A) $336. B)

Q14: Kristine sold two assets on March 20th

Q19: Teddy purchased only one asset during the

Q20: Tax depreciation is currently calculated under what

Q29: If tangible personal property is depreciated using

Q40: Taxpayers may use historical data to determine

Q45: Businesses may immediately expense research and experimentation

Q74: Property expensed under the §179 immediate expensing

Q82: Businesses deduct percentage depletion when they sell