Essay

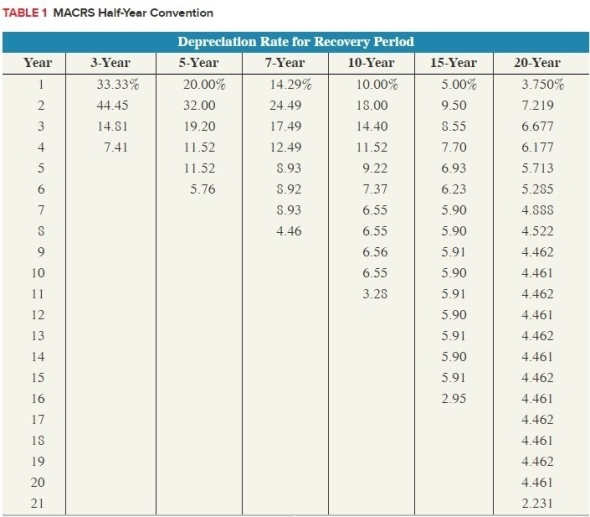

Northern LLC only purchased one asset this year. In 2017, Northern LLC placed in service on September 6th machinery and equipment (7-year property) with a basis of $2,200,000. Assume that Northern has sufficient income to avoid any limitations. Calculate the maximum depreciationexpense including §179 expensing (ignore any potential bonus expensing). (Use MACRS Table 1)(Round final answer to the nearest whole number)

Correct Answer:

Verified

$605,794

The $510,000 §179 expense is re...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The $510,000 §179 expense is re...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The method for tax amortization is always

Q43: Which of the following is not usually

Q44: Tax cost recovery methods do not include:<br>A)

Q46: During April of the current year, Ronen

Q47: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2607/.jpg" alt=" A) $480. B)

Q48: In general, a taxpayer should select longer-lived

Q50: Assume that Brittany acquires a competitor's assets

Q80: Real property is always depreciated using the

Q101: If a machine (seven-year property) being depreciated

Q128: If a taxpayer places only one asset