Essay

To be indifferent between investing in the two bonds, the Moe's, Inc. bond should provide Namratha t same after-tax rate of return as the city of Watkinsville bond (4.5%). To solve for the required pre-tax rate of return we can use the following formula: After-tax return = Pre-tax return × (1 - Marginal Tax Rate).

Moe's, Inc. needs to offer a 6% interest rate to generate a 4.5% after-tax return and make Namratha indifferent between investing in the two bonds.

4.5% = Pre-tax return × (1 - 25%); Pre-tax return = 4.5%/(1 - 25%) = 6%

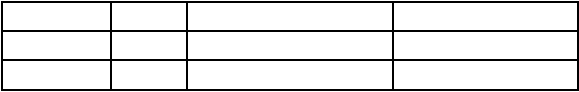

-Given the following tax structure, what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to beassessed on Lizzy to make the tax progressive with respect to effective tax rates?  Taxpayer Salary Muni-Bond Interest Total TaxMort 20,000 5,000 4,000Lizzy 80,000 30,000 ???

Taxpayer Salary Muni-Bond Interest Total TaxMort 20,000 5,000 4,000Lizzy 80,000 30,000 ???

Correct Answer:

Verified

Mort's average tax r...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Congress recently approved a new, smaller budget

Q5: Sin taxes are:<br>A) Taxes assessed to fund

Q6: Which of the following is true regarding

Q7: Al believes that SUVs have negative social

Q8: Earmarked taxes are:<br>A) Taxes assessed for only

Q10: Fred and Wilma, married taxpayers, earn $100,000

Q11: Which of the following represents the largest

Q14: Curtis invests $250,000 in a city of

Q65: A use tax is typically imposed by

Q115: Although the primary purpose of a tax