Multiple Choice

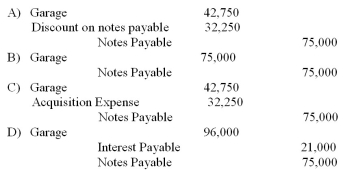

A company purchased a garage from a business with a 7%, 4-year, $75,000 note. The seller's book value for the garage was $42,750. What is the journal entry to record this purchase?

A) Option: A

B) Option: B

C) Option: C

D) Option: D

Correct Answer:

Verified

Correct Answer:

Verified

Q17: The fixed asset turnover ratio measures the:<br>A)useful

Q60: Accumulated depreciation is classified as a(an)<br>A)expense.<br>B)contra-asset.<br>C)liability.<br>D)stockholders' equity.

Q107: A loss on disposal of an asset

Q108: What is the adjusted balance in the

Q109: Beta Inc. acquired a machine on January

Q111: A company expects to use equipment that

Q112: company A uses an accelerated depreciation method

Q113: Residual value is the estimate of the

Q114: Furniture with a $3,000 sticker price is

Q115: At the beginning of 2010, your company