Multiple Choice

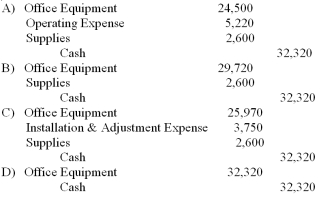

A company purchased office equipment for $24,500 and paid $1,470 in sales tax, $550 for installation, $3,200 for a needed adjustment to the equipment, and $2,600 for supplies that will be used for periodic routine

Maintenance. What is the journal entry to record this purchase?

A) Option: A

B) Option: B

C) Option: C

D) Option: D

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Once the depreciation expense for a long-lived

Q25: Your company buys a computer server,which it

Q52: A real estate management company buys an

Q59: Which of the following statements regarding straight-line

Q60: On January 1, 2013, Horton Inc. sells

Q69: Which of McGraw-Hill's intangible assets gives it

Q87: The book or carrying value of an

Q114: Freight costs incurred when a long-lived asset

Q124: Goodwill:<br>A)should be treated like most other intangible

Q144: Purrfect Pets has a facility that originally