Multiple Choice

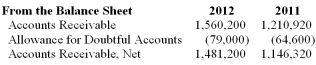

Assume the Mirtha Company had the following balances at year-end.  Assume the company recorded no write-offs or recoveries during 2012. What was the amount of bad debt expense reported in 2012?

Assume the company recorded no write-offs or recoveries during 2012. What was the amount of bad debt expense reported in 2012?

A) $79,000.

B) $64,600.

C) $28,800.

D) $14,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: A high accounts receivable turnover ratio indicates:<br>A)

Q52: At the end of the first year,the

Q80: Allowance for doubtful accounts is a temporary

Q93: Over the past five years, a company

Q93: On average,5% of credit sales has been

Q94: The receivables turnover ratio is calculated using

Q96: If the company is preparing financial statements

Q97: To record estimated uncollectible accounts using the

Q103: For each of the following transactions, indicate

Q119: Net accounts receivable is:<br>A)gross accounts receivable minus