Multiple Choice

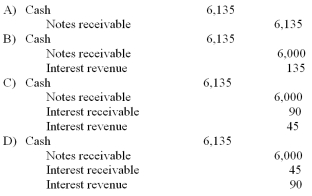

On December 1, 2010, a company accepted a $6,000, 9%, 3-month note from a customer in payment of his overdue account. The company prepares year-end financial statements on December 31. What entry should the company make on March 1, 2011, when the note and interest are paid?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Your company uses the percentage of credit

Q35: What is the amount due on the

Q115: The process of using accounts receivable as

Q116: The direct write off method is better

Q118: Which of the following is true?<br>A) Accounts

Q119: In the interest formula, the interest rate

Q121: The Dubious Company operates in an industry

Q123: The aging of accounts receivable method, also

Q124: In January 2012, the company writes off

Q126: Plasma Inc. ,has net credit sales of