Essay

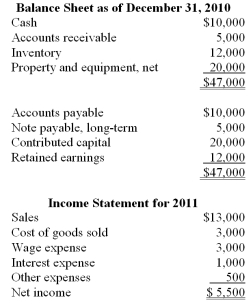

The Extra Surplus Company's Balance Sheet for December 31, 2010 and the Income Statement for 2011 are shown below.  Additional Data for 2011:

Additional Data for 2011:

Sales were $13,000; $8,000 in cash was received from customers.

Bought new land for cash, $10,000.

Sold other land for its book value of $5,000.

Paid $1,000 principal on the long-term note payable and $1,000 in interest. Issued new shares of stock for $10,000 cash.

$1,000 of dividends were declared and paid. Paid $5,500 on accounts payable.

No inventory purchases were made; other expenses were incurred on account. All wages were paid in cash.

Other expenses were on account.

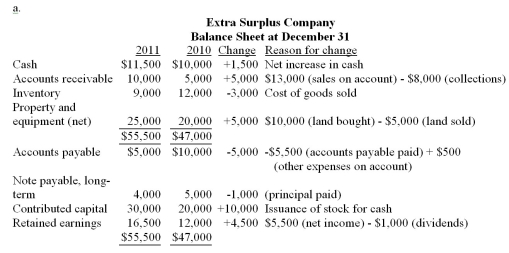

a. Prepare the statement of cash flows for the year ended December 31, 2011 using the indirect method. b. Prepare the statement of cash flows for the year ended December 31, 2011 using the direct method.

c. Interpret the statement of cash flows by explaining the main sources and uses of cash during the year.

Correct Answer:

Verified

a. Using the Indirect Method:  b. Using ...

b. Using ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Which of the following would be included

Q27: A company purchased money market funds with

Q29: Given this information, what is the amount

Q30: If a company's Cost of goods sold

Q33: B. Darin Company loaned $3,000,000 at 7%

Q34: Assume a company uses the direct method

Q35: The retained earnings account has a beginning

Q37: If a company's sales revenue was $171,356

Q37: The company would report net cash inflows

Q43: Depreciation expense is $20,000 and the beginning