Multiple Choice

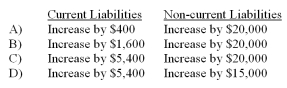

At the beginning of the quarter, your company borrows $20,000 by signing a four-year promissory note that states an annual interest rate of 8% plus principal repayments of $5,000 each year. Interest is paid at the end of the second and fourth quarters, whereas principal payments are due at the end of each year. How does this new promissory note affect the current and non-current liability amounts reported on the balance sheet at the end of the first quarter?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q36: A company typically records the amount owed

Q37: A contingent liability:<br>A)is always a specific amount.<br>B)is

Q62: The following data came from the financial

Q63: Unearned revenue is recorded as an asset

Q65: What is the issue price of these

Q68: How many of the following statements are

Q70: A company issues $200,000 in long-term bonds

Q71: Your company issued bonds at a discount.

Q115: When interest expense is calculated using the

Q218: Your company sells $50,000 of bonds for