Multiple Choice

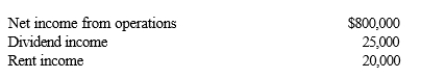

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity.Trout's taxable loss for the current year is $250,000.During the year, Catfish receives a $60,000 cash distribution from Trout.Other relevant data for Catfish are as follows.  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

A) $0

B) $20,000

C) $45,000

D) $112,500

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A limited partnership can indirectly avoid unlimited

Q18: When compared to a partnership, what additional

Q27: List some techniques for reducing and/or avoiding

Q28: Match the following statements.<br>-Net capital loss<br>A)For the

Q45: A corporation may alternate between S corporation

Q69: A limited liability company LLC) is a

Q88: Match the following statements.<br>-Net capital gain<br>A)For the

Q110: The tax treatment of S corporation shareholders

Q120: Mercedes owns a 30% interest in Magenta

Q140: Match each of the following statements with