Multiple Choice

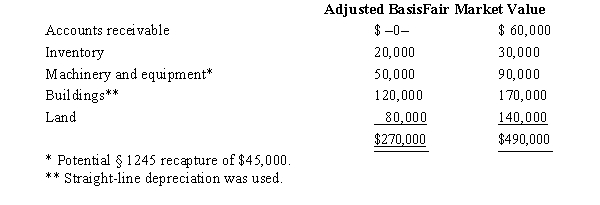

Albert's sole proprietorship owns the following assets.  Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Walter wants to sell his wholly owned

Q10: In the sale of a partnership, how

Q11: An S corporation election for Federal income

Q11: An S corporation is not subject to

Q32: Corey is going to purchase the assets

Q86: Match the following statements.<br>-Sale of the individual

Q96: Match the following statements.<br>-C corporations<br>A)Usually subject to

Q101: C corporations are not subject to AMT

Q104: In the purchase of a partnership, how

Q105: Match the following statements.<br>-Sale of an ownership