Multiple Choice

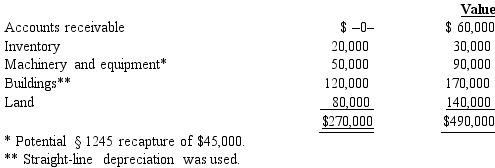

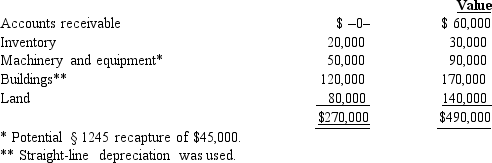

Mr.and Ms.Nguyen's partnership owns the following assets. Adjusted Basis Fair Market

Mr.and Ms.Nguyen each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Mr.and Ms.Nguyen each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Each of the following can pass profits

Q17: Match the following statements.<br>-Charitable contributions<br>A)For the corporate

Q38: Match the following statements.<br>-Sale of corporate stock

Q48: Arnold purchases a building for $750,000 which

Q50: Melinda's basis for her partnership interest is

Q54: The Net Investment Income Tax NIIT) is

Q61: With respect to special allocations, is the

Q82: Match the following attributes with the different

Q84: If a C corporation has earnings and

Q94: Aubrey has been operating his business as