Multiple Choice

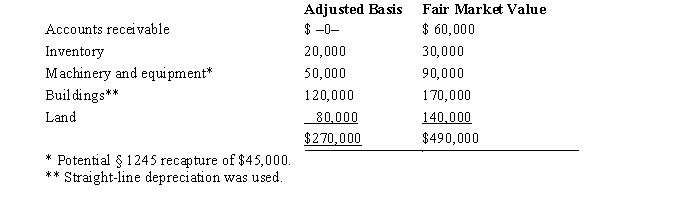

Kristine owns all of the stock of a C corporation which owns the following assets.  Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Walter wants to sell his wholly owned

Q11: An S corporation is not subject to

Q11: An S corporation election for Federal income

Q43: Thu and Tuan each own one-half of

Q44: Which of the following is correct regarding

Q50: Melinda's basis for her partnership interest is

Q61: With respect to special allocations, is the

Q76: Match the following statements.<br>-Partnerships<br>A)Usually subject to single

Q96: Match the following statements.<br>-C corporations<br>A)Usually subject to

Q104: In the purchase of a partnership, how