Multiple Choice

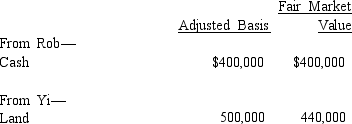

Rob and Yi form Bluebird Corporation with the following investments.  Each receives 50% of Bluebird's stock.In addition, Yi receives cash of $40,000.One result of these transfers is that Yi has a:

Each receives 50% of Bluebird's stock.In addition, Yi receives cash of $40,000.One result of these transfers is that Yi has a:

A) Recognized loss of $60,000.

B) Recognized loss of $20,000.

C) Basis of $460,000 in the Bluebird stock assuming Bluebird reduces its basis in the land to $440,000) .

D) Basis of $400,000 in the Bluebird stock assuming Bluebird reduces its basis in the land to $440,000) .

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Donald owns a 45% interest in a

Q41: Don, the sole shareholder of Pastel Corporation

Q53: When consideration is transferred to a corporation

Q65: Eagle Company, a partnership, had a short-term

Q73: Tina incorporates her sole proprietorship with assets

Q83: Adam transfers cash of $300,000 and land

Q85: Rachel owns 100% of the stock of

Q94: Joe and Kay form Gull Corporation. Joe

Q98: When incorporating her sole proprietorship, Samantha transfers

Q108: Which of the following statements is correct