Multiple Choice

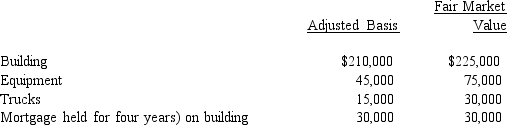

Rick transferred the following assets and liabilities to Warbler Corporation.  In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding fair market value of $225,000) .

In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding fair market value of $225,000) .

A) Rick has a recognized gain of $60,000.

B) Rick has a recognized gain of $75,000.

C) Rick's basis in the stock of Warbler Corporation is $270,000.

D) Warbler Corporation has the same basis in the assets received as Rick does in the stock.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Lilac Corporation incurred $4,700 of legal and

Q9: Under Federal tax law, a bias exists

Q14: A person who performs services for a

Q19: Silver Corporation receives $1 million in cash

Q21: A corporation with $5 million or more

Q26: In structuring the capitalization of a corporation,

Q28: Thrush Corporation, a calendar year C corporation,

Q50: Jane transfers property (basis of $180,000 and

Q79: No dividends received deduction is allowed unless

Q98: Erica transfers land worth $500,000, basis of