Multiple Choice

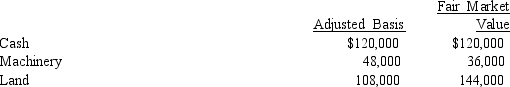

Donghai transferred the following assets to Starling Corporation.  In exchange, Donghai received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However, all parties believe that the value of the stock Donghai received is the equivalent of the value of the assets she transferred.The only other shareholder, Rick, formed Starling Corporation five years ago.

In exchange, Donghai received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However, all parties believe that the value of the stock Donghai received is the equivalent of the value of the assets she transferred.The only other shareholder, Rick, formed Starling Corporation five years ago.

A) Donghai has no gain or loss on the transfer.

B) Starling Corporation has a basis of $48,000 in the machinery and $108,000 in the land.

C) Starling Corporation has a basis of $36,000 in the machinery and $144,000 in the land.

D) Donghai has a basis of $276,000 in the stock of Starling Corporation.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Rachel is the sole member of an

Q30: Three individuals form Skylark Corporation with the

Q45: During the current year, Sparrow Corporation, a

Q54: Alan, an Owl Corporation shareholder, makes a

Q57: Similar to like-kind exchanges, the receipt of

Q61: A city contributes $500,000 to a corporation

Q65: A taxpayer may never recognize a loss

Q71: The use of § 351 is not

Q77: A calendar year C corporation can receive

Q93: One month after Sally incorporates her sole