Multiple Choice

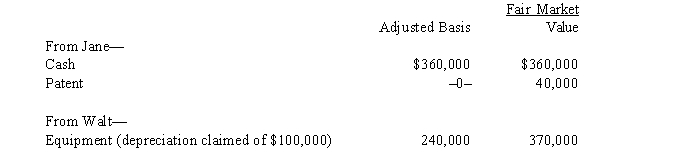

Four individuals form Chickadee Corporation under § 351.Two of these individuals, Jane and Walt, made the following contributions:  Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A) Jane must recognize income of $40,000; Walt has no income.

B) Neither Jane nor Walt recognize income.

C) Walt must recognize income of $130,000; Jane has no income.

D) Walt must recognize income of $100,000; Jane has no income.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: An expense that is deducted in computing

Q26: In structuring the capitalization of a corporation,

Q42: In general, the basis of property to

Q43: A shareholder contributes land to his wholly

Q49: Jake, the sole shareholder of Peach Corporation,

Q73: Gabriella and Juanita form Luster Corporation. Gabriella

Q91: Hornbill Corporation, a cash basis and calendar

Q98: Erica transfers land worth $500,000, basis of

Q109: Schedule M-3 is similar to Schedule M-1

Q110: Schedule M-2 is used to reconcile unappropriated