Essay

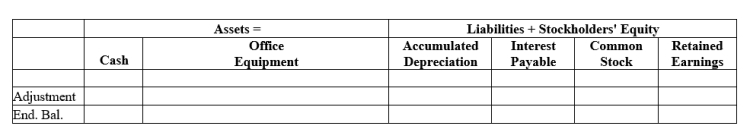

Identify the type of adjustment necessary (the type of item involved) and record the transaction for the event.Make sure to include the ending balances after adjustment.

On June 1, Carter Lights Corp.borrowed $38,000 from the bank by signing a promissory note from the bank, with 7% interest.The note is due in three months.Interest for June has been incurred but not yet recorded.The interest to accrue for June is $180.The June 30 adjustment is:

Correct Answer:

Verified

Correct Answer:

Verified

Q61: Accrued expenses are expenses that have been

Q62: From the following data for David

Q63: When cash is received in payment of

Q64: Expenses not related to the primary operations

Q66: On April 1, Tenity, Inc.paid $3,300 for

Q67: To determine cash payments for operating expenses

Q68: Perill Co.has a five-day workweek (Monday through

Q69: Identify the type of adjustment necessary (the

Q70: Which of the following metrics is affected

Q92: Using accrual accounting, expenses are recorded and