Short Answer

Use the following information for items

The Colin Division of Mochrie Company sells its product for $30 per unit.Variable costs per unit are: manufacturing, $12; and selling and administrative, $2.Fixed costs are: $200,000 manufacturing overhead, and $50,000 selling and administrative.There was no beginning inventory.Expected sales for next year are 40,000 units.Ryan Stiles, the manager of the Colin Division, is under pressure to improve the performance of the Division.As he plans for next year, he has to decide whether to produce 40,000 units or 50,000 units.

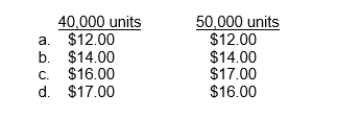

-What would the anufacturing cost per unit be under variable costing for each alternative?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Under absorption costing:<br>A)Only direct variable manufacturing costs

Q2: Use the following information for items <br>Green

Q3: EKP's unit production cost under variable costing

Q7: A customer wants to purchase a large

Q8: Under variable costing:<br>A)Only direct variable manufacturing costs

Q9: When production exceeds sales<br>A)Ending inventory under variable

Q19: The computation of absorption-costing gross profit always

Q28: Use the following information for items <br>Obama

Q34: GAAP requires that absorption costing be used

Q35: When absorption costing is used, management may