Short Answer

Use the following information for items

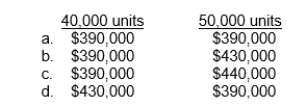

The Colin Division of Mochrie Company sells its product for $30 per unit.Variable costs per unit are: manufacturing, $12; and selling and administrative, $2.Fixed costs are: $200,000 manufacturing overhead, and $50,000 selling and administrative.There was no beginning inventory.Expected sales for next year are 40,000 units.Ryan Stiles, the manager of the Colin Division, is under pressure to improve the performance of the Division.As he plans for next year, he has to decide whether to produce 40,000 units or 50,000 units.

-What would the net income be under variable costing for each alternative?

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Under absorption costing, what amount of fixed

Q13: Which of the following statements about variable

Q18: When units sold exceeds units produced<br>A)net income

Q19: Use the following information for items <br>The

Q20: Under normal costing:<br>A)Only direct variable manufacturing costs

Q25: If a division manager's compensation is based

Q26: Under absorption costing:<br>A)Only the quantity of products

Q32: When units produced exceeds units sold<br>A)net income

Q52: Full costing is equivalent to absorption costing.

Q65: Which of the following terms would be