Multiple Choice

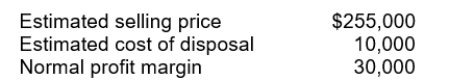

Walter Distribution Co.has determined its December 31, 2010 inventory on a FIFO basis at $240,000.Information pertaining to that inventory follows:  Walter records losses that result from applying the lower of cost and market rule.At December 31, 2010, the loss that Walter should recognize is

Walter records losses that result from applying the lower of cost and market rule.At December 31, 2010, the loss that Walter should recognize is

A) $0.

B) $5,000.

C) $15,000.

D) $25,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Use the following information for questions <br>

Q33: Use the following information for questions <br>Toby

Q34: A manufacturing company typically has the following

Q35: Which of the following formulas is used

Q36: Assume that the proper correcting entries were

Q38: Use the following information for questions <br>

Q39: Oxley Retailers purchased merchandise with a list

Q41: A mark-up of 35% on cost is

Q42: In 2010, Garrison Corporation reported net income

Q64: The gross profit percentage is calculated by<br>A)