Multiple Choice

Use the following information for questions

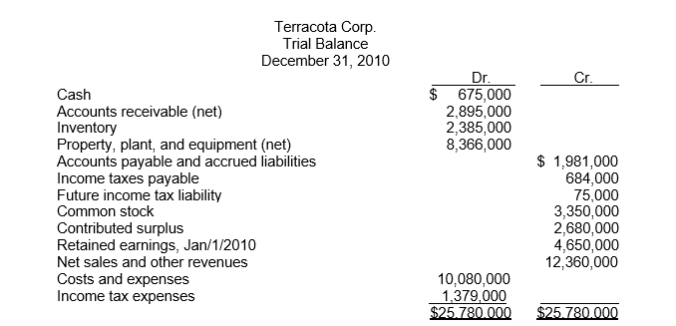

The following trial balance of Terracota Corp.at December 31, 2010 has been properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2010:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2012.

The balance in the Future Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.

The current and future tax rate on all types of income is 35 percent.In Terracota's December 31, 2010 balance sheet,

-The final retained earnings balance is

A) $5,551,000.

B) $6,016,000

C) $5,135,000.

D) $6,431,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following would be classified

Q16: In a statement of cash flows, payments

Q18: The standards for private entity GAAP and

Q19: A company's petty cash fund of $450

Q20: Monetary assets are defined as assets that

Q21: The basis for classifying assets as current

Q22: Treasury stock should be reported as a(n)<br>A)current

Q26: When current debt is refinanced by the

Q78: Which item below is not a current

Q116: In a statement of cash flows, receipts