Short Answer

SCENARIO 3-8

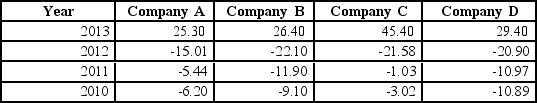

The period from 2010 to 2013 saw a great deal of volatility in the value of stocks.The data in the following table represent the total rate of return of our companies from 2010 to 2013.

-Referring to Scenario 3-8,calculate the geometric mean rate of return per year for Company A.

Correct Answer:

Verified

Correct Answer:

Verified

Q82: You were told that the 1<sup>st</sup>,2<sup>nd</sup> and

Q83: SCENARIO 3-7<br>In a recent academic year,many public

Q84: SCENARIO 3-6<br>The rate of return of an

Q85: SCENARIO 3-5<br>The rate of return of a

Q86: SCENARIO 3-1<br>Health care issues are receiving much

Q88: SCENARIO 3-7<br>In a recent academic year,many public

Q89: SCENARIO 3-11<br>Given below are the closing prices

Q90: SCENARIO 3-5<br>The rate of return of a

Q91: SCENARIO 3-3<br>The ordered array below represents the

Q92: SCENARIO 3-8<br>The period from 2010 to 2013