Multiple Choice

SCENARIO 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

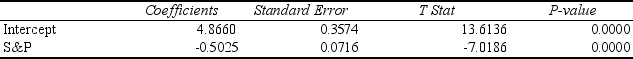

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index

(X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7,which of the following will be a correct conclusion?

A) You cannot reject the null hypothesis and,therefore,conclude that there is sufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

B) You can reject the null hypothesis and,therefore,conclude that there is sufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

C) You cannot reject the null hypothesis and,therefore,conclude that there is insufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

D) You can reject the null hypothesis and conclude that there is insufficient evidence to show that the prisons stock portfolio and S&P 500 index are negatively related.

Correct Answer:

Verified

Correct Answer:

Verified

Q101: The Regression Sum of Squares (SSR)can never

Q102: SCENARIO 13-1<br>A large national bank charges

Q103: SCENARIO 13-12<br>The manager of the purchasing department

Q104: SCENARIO 13-4<br>The managers of a brokerage firm

Q105: SCENARIO 13-6<br>The following Excel tables are obtained

Q107: SCENARIO 13-3<br>The director of cooperative education at

Q108: If the plot of the residuals is

Q109: SCENARIO 13-4<br>The managers of a brokerage firm

Q110: SCENARIO 13-12<br>The manager of the purchasing department

Q111: SCENARIO 13-12<br>The manager of the purchasing department