Multiple Choice

Use the following information to answer questions

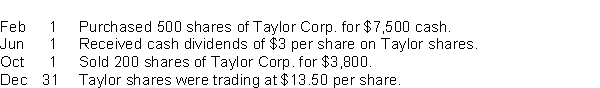

Wells Inc.reported these transactions relating to marketable Trading Investments intended to generate net income and to be sold in the near term:

-The entry to record the sale of the shares on Oct 1 would include a

A) credit to Trading Investments for $3,800.

B) credit to Realized Gain for $800.

C) credit to Unrealized Gain for $800.

D) debit to Unrealized Gain for $3,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q101: Debt investments held to earn interest income

Q102: When investing excess cash for short periods

Q103: Debt investments are all of the following

Q104: Use the following information for questions <br>On

Q105: If the fair value through other comprehensive

Q107: Which one of the following would not

Q108: Short-term investments in bonds are accounted for

Q109: Republic Corp.owns a 15% interest in the

Q110: On January 1, 2022, Coastal Corp.purchased 30%

Q111: The amortization of a bond investment is