Short Answer

Use the following information for questions

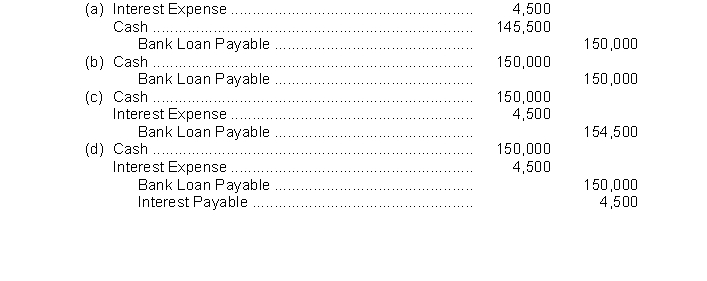

On January 1 of this year, Saratoga Bank agrees to lend Tilbury Corp. $150,000. Tilbury Corp. signs a $150,000, 4%, 9-month loan. Interest is due at maturity.

-The entry made by Tilbury Corp on January 1 to record the receipt of the loan is

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Property tax payable is classified as a

Q60: For bond amortization, private companies reporting under

Q82: If bonds are issued at a premium,

Q84: When a bond is issued at a

Q85: On March 1, Broke Corp. issues a

Q88: Current liabilities are<br>A)not receivable for more than

Q89: Over the term of a bond, if

Q90: The total interest cost for a bond

Q91: GST (goods and services tax) collected by

Q105: "Current maturities of non-current debt" refers to