Multiple Choice

Use the following information to answer questions

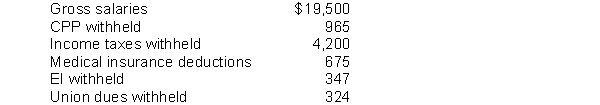

The following totals for the month of April were taken from the payroll register of Sandhu Corp.

-Assuming Sandhu Corp is also required to remit 140% of the employees' EI withholdings as their share of employee benefits, the journal entry to record the accrual of the employer's portion of EI would include a

A) credit to EI Payable of $486.

B) debit to EI Expense of $347.

C) credit to EI Payable of $347.

D) debit to EI Payable of $486.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: One thousand bonds, with a face value

Q5: A bond with a face value of

Q11: Dream Design Inc. received its annual property

Q25: With fixed principal payments on a long-term

Q58: Payroll liabilities include the employer's share of

Q62: $5 million, 8%, 10-year bonds are issued

Q64: A financial liability means there is a

Q66: Contingent liabilities should be recorded in the

Q85: If any portion of a non-current liability

Q112: A long-term note may be secured by