Short Answer

Use the following information for questions

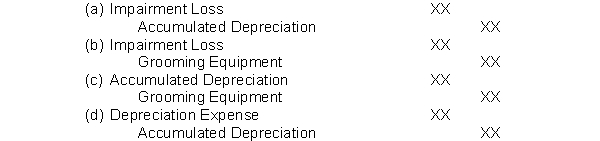

Pierre's Pet Shop Limited bought new grooming equipment on January 1, 2012 for $13,000. The useful life is estimated to be 3 years with a residual value of $1,000. The company uses straight-line depreciation. On January 1, 2013, Pierre determined that the value of the equipment is impaired, as its recoverable amount is expected to be $4,800.

-The journal entry to record the impairment would involve debits and credits to the following accounts:

Correct Answer:

Verified

Correct Answer:

Verified

Q30: If the return on assets is positive,

Q31: Which of the following is an intangible

Q32: When estimating the useful life of an

Q33: Use the following information for questions<br>On January

Q34: Aye Corp purchases a remote site building

Q37: The depreciation method that applies a constant

Q39: Use the following information for questions<br>On January

Q78: The cash flows from the purchase and

Q137: A machine that cost $72,000 has an

Q142: The cost of land does <i>not</i> include<br>A)closing