Multiple Choice

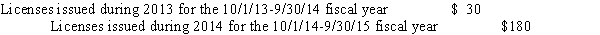

A city with a 12/31 fiscal year-end requires that restaurants buy a license, renewable yearly.Proceeds of the license fees are intended to pay the salaries of inspectors in the health department.Licenses are issued for a fiscal year from October 1 to September 30.During 2014, cash collections related to licenses were as follows  It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45.In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144.What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14?

It is anticipated that during 2015 the amount collected on licenses for the 10/1/14-9/30/15 fiscal year will be $45.In September 2013 the amount collected related to 10/1/13-9/30/14 licenses was $144.What amount should be recognized as revenue in the fund financial statements for the fiscal year ended 12/31/14?

A) $180.

B) $183.

C) $210.

D) $225.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: As used in defining the modified accrual

Q6: A city levies a 2 percent sales

Q7: During 2014, a state has the following

Q8: During 2014, the city issued $300 in

Q10: Under the accrual basis of accounting used

Q20: Under the modified accrual basis of accounting,

Q39: A city is the recipient of a

Q47: If an entity elects to focus on

Q65: Taxes that are imposed on the reporting

Q68: Reimbursement-type grant revenues are recognized in the