Short Answer

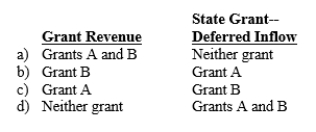

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2013.Grant A can be used to cover any operating expenses incurred during fiscal 2014.Grant B can be used at any time to acquire equipment for the city's fire department.Should the city report these grants as grant revenues or deferred inflows in its government-wide financial statements for fiscal 2013?

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Revenues that cannot be classified as general

Q26: Ad valorem taxes are taxes that are

Q45: At the beginning of its fiscal year,

Q46: Endowments are provided to governments with the

Q47: A local government began the year with

Q50: A city levies a 2 percent sales

Q51: A city that has a 12/31 fiscal

Q53: During 2014, a state has the following

Q69: Under the modified accrual basis, revenues are

Q70: A city receives notice of a $150,000