Essay

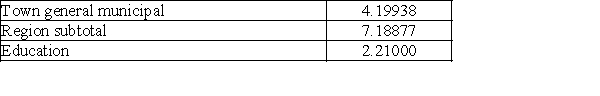

Paul is a homeowner in Whitby and his home value has been recently assessed by MPAC as $339 500. Paul's tax notice lists the following mill rates for various local services and capital developments. Calculate current year's total property tax.

Correct Answer:

Verified

Total property tax rate = 4.19...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Evaluate: 400(1 + .10 ∗ 100/365)

Q15: In 2011, Danny invested his savings among

Q44: A town has a total residential assessment

Q74: Simplify: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4212/.jpg" alt="Simplify: A)-1.5

Q81: Simplify: 6 + <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4212/.jpg" alt="Simplify: 6

Q82: Complete the following statement: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4212/.jpg" alt="Complete

Q99: Simplify: (14 + 7)/3

Q102: Express the following as a percent: 4.55

Q128: R.J. earns $11.70 an hour, with time-and-a-half

Q144: Jessica Hughes invested $40 000 on January