Multiple Choice

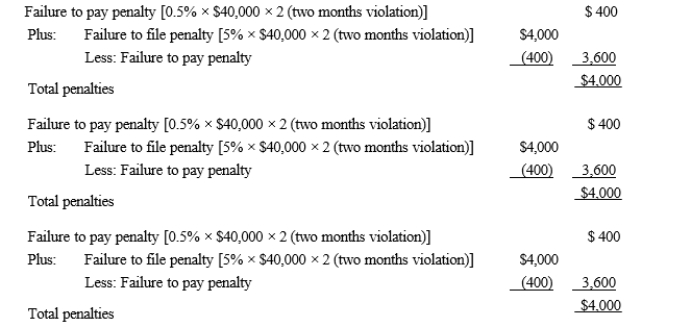

David files his tax return 45 days after the due date.Along with the return, David remits a check for $40,000.which is the balance of the tax owed.Disregarding the interest element, David's total failure to file and to pay penalties are:

A) $400.

B) $3,600.

C) $4,000.

D) $4,400.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q147: Ultimately, most taxes are paid by individuals.

Q148: Using the following choices, show the justification

Q149: For the negligence penalty to apply, the

Q150: Both economic and social considerations can be

Q151: Using the following choices, show the justification

Q153: A state income tax can be imposed

Q154: Using the following choices, show the justification

Q155: Even though a client refuses to correct

Q156: The ratification of the Sixteenth Amendment to

Q157: On occasion, Congress has to enact legislation