Multiple Choice

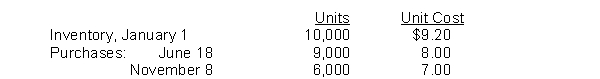

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. If the company uses FIFO, what is the gross profit for the period?

A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. If the company uses FIFO, what is the gross profit for the period?

A) $95,000

B) $99,266

C) $99,960

D) $103,800

Correct Answer:

Verified

Correct Answer:

Verified

Q28: The specific identification method of inventory valuation

Q65: In applying the LIFO assumption in a

Q81: Netta Shutters has the following inventory information.

Q82: The lower-of-cost-or-market basis of valuing inventories is

Q85: At May 1, 2015, Kibbee Company had

Q87: H. Hunter Company's records indicate the following

Q88: A company just starting business made the

Q90: Switzer, Inc. has 8 computers which have

Q108: The accountant at Cedric Company has determined

Q145: Goods that have been purchased FOB destination