Multiple Choice

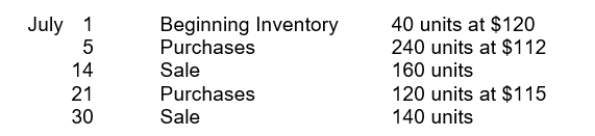

Moroni Industries has the following inventory information.  Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a FIFO basis?

Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a FIFO basis?

A) $11,500

B) $11,520

C) $33,960

D) $33,980

Correct Answer:

Verified

Correct Answer:

Verified

Q7: If companies have identical inventoriable costs but

Q72: Under the retail inventory method the estimated

Q75: The specific identification method of costing inventories

Q141: The requirements for accounting for and reporting

Q143: Othello Company understated its inventory by $20,000

Q148: At May 1, 2015, Kibbee Company had

Q166: The lower-of-cost-or-market basis is an example of

Q176: The selection of an appropriate inventory cost

Q182: The LIFO inventory method assumes that the

Q226: Cost of goods sold is computed from