Multiple Choice

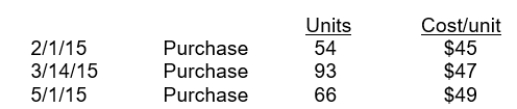

Romanoff Industries had the following inventory transactions occur during 2015:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using LIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using LIFO? (rounded to whole dollars)

A) $2,323

B) $2,486

C) $3,318

D) $3,552

Correct Answer:

Verified

Correct Answer:

Verified

Q5: In a period of falling prices the

Q6: Which of the following items will increase

Q18: In a period of rising prices FIFO

Q34: The major IFRS requirements related to accounting

Q38: GAAP defines market for lower-of-cost-or market essentially

Q42: Effie Company uses a periodic inventory system.

Q47: Which of the following statements is true

Q122: Under generally accepted accounting principles management has

Q155: Which of the following is not a

Q174: The managers of Constantine Company receive performance