Multiple Choice

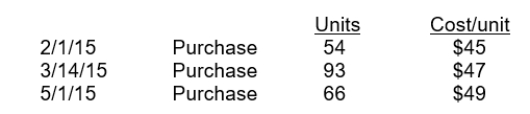

Romanoff Industries had the following inventory transactions occur during 2015:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

A) $3,318

B) $3,552

C) $6,948

D) $7,182

Correct Answer:

Verified

Correct Answer:

Verified

Q44: A company may use more than one

Q59: The convergence issue that will be most

Q60: Eneri Company's inventory records show the following

Q61: Inventory accounting under IFRS differs from GAAP

Q63: <sup></sup>138. Pappy's Staff has the following inventory

Q65: Eneri Company's inventory records show the following

Q99: Overstating ending inventory will overstate all of

Q103: In a perpetual inventory system the cost

Q125: The retail inventory method requires a company

Q184: The specific identification method of costing inventories