Multiple Choice

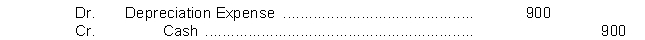

A new accountant working for Spirit Walker Company records $900 Depreciation Expense on store equipment as follows:  The effect of this entry is to

The effect of this entry is to

A) adjust the accounts to their proper amounts on December 31.

B) understate total assets on the balance sheet as of December 31.

C) overstate the book value of the depreciable assets at December 31.

D) understate the book value of the depreciable assets as of December 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Accrued revenues are<br>A) cash received and a

Q29: The revenue recognition principle dictates that revenue

Q38: Double Nickels Company purchased equipment for $9,000

Q42: Ultramega Company collected $19,600 in May of

Q64: Accumulated Depreciation is<br>A) an expense account.<br>B) a

Q70: Unearned revenues are<br>A) cash received and a

Q72: The revenue recognition principle dictates that revenue

Q152: The time period assumption states that<br>A) a

Q162: Jackson Cement Corporation reported $35 million for

Q201: A small company may be able to