Multiple Choice

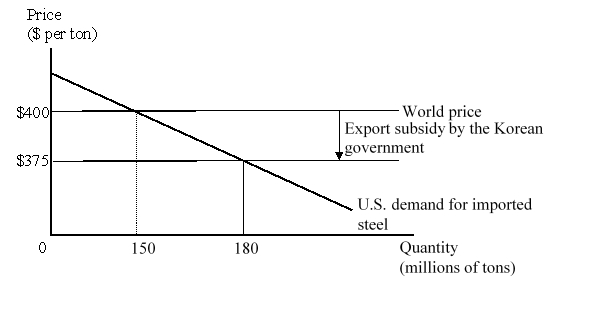

The figure given below represents the U.S. market for steel imports from Korea. The Korean government provides an export subsidy of $25 per ton, and Korean firms use the subsidy to reduce their export price to the United States to $375 per ton.  Suppose the United States now imposes a countervailing duty on its steel imports from Korea to offset the impact of the subsidy provided by the Korean government on its steel exports. Calculate the change in the national welfare of the U.S. due to the imposition of this duty.

Suppose the United States now imposes a countervailing duty on its steel imports from Korea to offset the impact of the subsidy provided by the Korean government on its steel exports. Calculate the change in the national welfare of the U.S. due to the imposition of this duty.

A) -$375 million

B) +$3.375 billion

C) +$3.75 billion

D) -$4.125 billion

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Assume that country A provides a subsidy

Q2: In 1992, the bilateral agreement of the

Q4: The figure given below represents the

Q5: It is generally the case that imposing

Q6: _ occurs when a firm temporarily charges

Q7: The impact on world welfare of an

Q8: Aggressive competition in the foreign market through

Q9: With free trade the United States imports

Q10: The figure given below represents the domestic

Q11: The figure given below represents the domestic