Multiple Choice

Use the following information for questions.

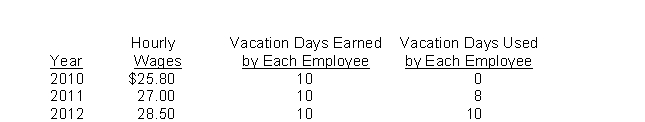

Vargas Company has 35 employees who work 8-hour days and are paid hourly.On January 1, 2010, the company began a program of granting its employees 10 days of paid vacation each year.Vacation days earned in 2010 may first be taken on January 1, 2011.Information relative to these employees is as follows:

Vargas has chosen to accrue the liability for compensated absences at the current rates of pay in effect when the compensated time is earned.

-What is the amount of the accrued liability for compensated absences that should be reported at December 31, 2012?

A) $94,920.

B) $90,720.

C) $79,800.

D) $95,760.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: On January 1, 2010, Beyer Co.leased a

Q4: A contingent liability<br>A)definitely exists as a liability

Q4: Examples of contingent assets include all of

Q5: On December 31, 2011, Frye Co.has £4,000,000

Q6: Glaus Corp.signed a three-month, zero-interest-bearing $152,205 note

Q8: During 2010, Eaton Co.introduced a new product

Q9: Liabilities are<br>A)any accounts having credit balances after

Q10: On January 3, 2010, Boyer Corp.owned a

Q12: Yount Trading Stamp Co.records stamp service revenue

Q68: Which of the following is the proper