Multiple Choice

Use the following information for questions.

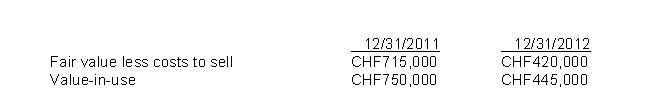

On January 2, 2011, Lutz Inc.purchased a patent with a cost CHF940,000 a useful life of 4 years.At December 31, 2011, and December 31, 2012, the company determines that impairment indicators are present.The following information is available for impairment testing at each year end:

No changes were made in the asset's estimated useful life.

-The company's 2012 income statement will report

A) Amortization Expense of CHF235,000

B) Amortization Expense of CHF235,000 and Loss on Impairment of CHF10,000.

C) Amortization Expense of CHF235,000 and a Recovery of Impairment of CHF45,000.

D) Loss on impairment of 190,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: A recovery of impairment for an intangible

Q23: If a company constructs a laboratory building

Q60: On August 1, 2011, Li Inc.purchased a

Q61: Purchased goodwill should<br>A) be written off as

Q61: Malrom Manufacturing Company acquired a patent on

Q63: MaBelle Corporation incurred the following costs in

Q64: On August 1, 2011, Wei Inc.purchased a

Q71: If a new patent is acquired through

Q77: Companies are required to assess the estimated

Q119: Research and development costs that result in