Multiple Choice

Use the following information for questions.

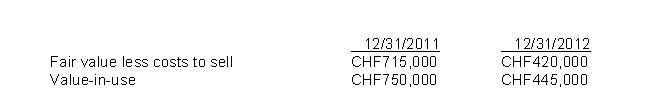

On January 2, 2011, Lutz Inc.purchased a patent with a cost CHF940,000 a useful life of 4 years.At December 31, 2011, and December 31, 2012, the company determines that impairment indicators are present.The following information is available for impairment testing at each year end:

No changes were made in the asset's estimated useful life.

-The company's 2012 income statement will report

A) Amortization Expense of CHF235,000.

B) Amortization Expense of CHF250,000 and Loss on Impairment of CHF55,000.

C) Amortization Expense of CHF235,000 and a Loss of Impairment of CHF25,000.

D) Loss on impairment of CHF70,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Which intangible assets are amortized? <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3161/.jpg"

Q33: During 2011, Leon Co.incurred the following costs:

Q34: Which of the following should not be

Q37: On May 5, 2011, MacDougal Corp.exchanged 2,000

Q39: On June 2, 2011, Olsen Inc.purchased a

Q41: Lopez Corp.incurred $420,000 of research costs to

Q47: Which of the following does not describe

Q54: Which characteristic is not possessed by intangible

Q71: When a company develops a trademark the

Q113: Limited-life intangibles are amortized by systematic charges