Multiple Choice

Use the following information for questions.

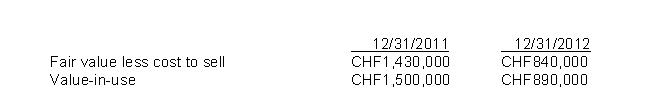

On January 2, 2011, Ace Inc.purchased a patent with a cost CHF1,880,000, and a useful life of 4 years.At December 31, 2011, and December 31, 2012, the company determines that impairment indicators are present.The following information is available for impairment testing at each year end:

No changes were made in the asset's estimated useful life.

-The company's 2012 income statement will report

A) Amortization Expense of CHF470,000.

B) Amortization Expense of CHF470,000 and Loss on Impairment of CHF20,000.

C) Amortization Expense of CHF470,000 and a Recovery of Impairment of CHF90,000.

D) Loss on impairment of 380,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Operating losses incurred during the start-up years

Q10: All intangibles are subject to periodic consideration

Q48: A loss on impairment of an intangible

Q66: Research and development costs are recorded as

Q77: Which of the following costs should be

Q90: Costs incurred internally to create intangibles are<br>A)

Q99: Goodwill may be recorded when<br>A) it is

Q115: Loazia Inc.incurred the following costs during the

Q121: Wriglee, Inc. went to court this year

Q122: A company acquires a patent for a