Multiple Choice

Use the following information for questions.

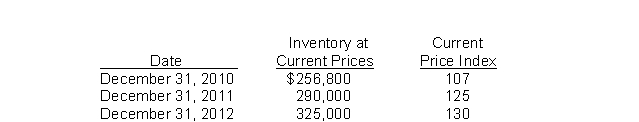

Gross Corporation adopted the dollar-value LIFO method of inventory valuation on December 31, 2009.Its inventory at that date was $220,000 and the relevant price index was 100.Information regarding inventory for subsequent years is as follows:

-What is the cost of the ending inventory at December 31, 2010 under dollar-value LIFO?

A) $240,000.

B) $256,800.

C) $241,400.

D) $235,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: A disadvantage of LIFO is that it

Q21: A trade discount that is granted as

Q28: Tanner Corporation's inventory cost on its statement

Q31: An inventory pricing procedure in which the

Q43: Culver Company purchases the majority of its

Q51: Freight costs incurred by the seller to

Q53: In a period of falling prices, which

Q128: What is a LIFO reserve?<br>A) The difference

Q134: Amazon.com (USA) and other e-tailers account for

Q135: The following information applied to Howe, Inc.for