Multiple Choice

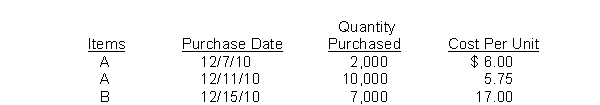

Wise Company adopted the dollar-value LIFO method on January 1, 2010, at which time its inventory consisted of 6,000 units of Item A @ $5.00 each and 3,000 units of Item B @ $16.00 each.The inventory at December 31, 2010 consisted of 12,000 units of Item A and 7,000 units of Item B.The most recent actual purchases related to these items were as follows:  Using the double-extension method, what is the price index for 2010 that should be computed by Wise Company?

Using the double-extension method, what is the price index for 2010 that should be computed by Wise Company?

A) 108.33%

B) 109.59%

C) 111.05%

D) 220.51%

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Willy World began using dollar-value LIFO for

Q4: Hite Co.was formed on January 2, 2010,

Q6: Use the following information for <br>RF Company

Q9: The acquisition cost of a certain raw

Q10: Milford Company had 400 units of "Tank"

Q11: Opera Corp.uses dollar-value LIFO method of computing

Q12: Computers For You is a retailer specializing

Q13: Elkins Corporation uses the perpetual inventory method.On

Q37: Abnormal freight costs are not included on

Q156: LIFO liquidation often distorts net income, but