Multiple Choice

Jerry recently was offered a position with a major accounting firm.The firm offered Jerry either a signing bonus of $23,000 payable on the first day of work or a signing bonus of $26,000 payable after one year of employment.Assuming that the relevant interest rate is 10%, which option should Jerry choose?

A) The options are equivalent.

B) Insufficient information to determine.

C) The signing bonus of $23,000 payable on the first day of work.

D) The signing bonus of $26,000 payable after one year of employment.

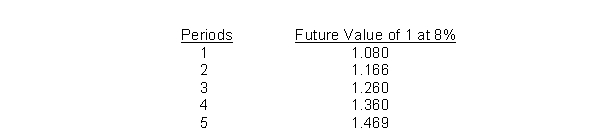

Items 56 through 58 apply to the appropriate use of interest tables.Given below are the future value factors for 1 at 8% for one to five periods.Each of the items 56 to 58 is based on 8% interest Compounded annually.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: What interest rate (the nearest percent) must

Q48: At the date of issue, bond buyers

Q50: Assume ABC Company deposits $25,000 with First

Q51: Use the following 8% interest factors for

Q52: Pearson Corporation makes an investment today (January

Q54: On January 1, 2012, Haley Co.issued ten-year

Q57: Simple interest is computed on principal and

Q60: Jane wants to set aside funds to

Q61: Which table would you use to determine

Q83: Which factor would be greater - the