Multiple Choice

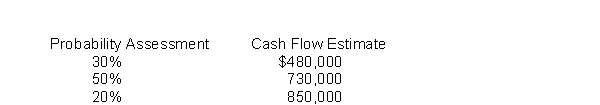

Reegan Company owns a trade name that was purchased in an acquisition of Hamilton Company.The trade name has a book value of $3,500,000, but according to GAAP, it is assessed for impairment on an annual basis.To perform this impairment test, Reegan must estimate the fair value of the trade name.It has developed the following cash flow estimates related to the trade name based on internal information.Each cash flow estimate reflects Reegan's estimate of annual cash flows over the next 7 years.The trade name is assumed to have no residual value after the 7 years.(Assume the cash flows occur at the end of each year.)  Reegan determines that the appropriate discount rate for this estimation is 6%.To the nearest dollar, what is the estimated fair value of the trade name?

Reegan determines that the appropriate discount rate for this estimation is 6%.To the nearest dollar, what is the estimated fair value of the trade name?

A) $3,500,000

B) $ 679,000

C) $2,060,000

D) $3,790,436

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Compound interest uses the accumulated balance at

Q9: Moore Industries manufactures exercise equipment.Recently the vice

Q10: Altman Company will invest $300,000 today.The investment

Q12: If Jethro wanted to save a set

Q17: If $4,000 is put in a savings

Q49: Interest is the excess cash received or

Q77: Stemway requires a new manufacturing facility. Management

Q87: Which of the following tables would show

Q115: Jane wants to set aside funds to

Q133: Which table would you use to determine